This is one topic that is more talked about than acted upon since generations. Successive governments wow to bring back to India what is now rumored to be stored outside India and famously called as “Black Money” (BM). While there is no clear and comprehensive definition of what it means, it simply means anything that is not “white money” or “legal money”.

Why should we worry about it? Because it has grown in size over the time to constitute now roughly about Rs.30 lakh crores as per some estimate. Take a guess on how many zero’s that is and most probably you will fail! Going by this, it surely is a parallel economy. But there are no firm estimates on how much it is. Going by the Global Financial Integrity report of IMF, it is a measly $4.7 billion equivalent to 0.03% of our GDP. Hardly a number that you should be losing your sleep on. But the unofficial estimates can go up to 20% of GDP. To be fair, India is not alone in generating huge black money. We keep company with countries like China, Russia, Mexico, Malaysia, Nigeria (some of the countries with the highest black money). However, just because we have several countries at it, does not give any reason to be complacent about it. India is the 34th country in the list of highest black money, a rank that we want to be low not high!

It may be interesting to note that there are some BM friendly sectors like Real estate, land dealings, financing, Non-profit entities, Entertainment, Bullion (gold), etc that acts as the main generator of BM. These sectors are BM friendly due to loose regulations and high taxes which motivates people to evade the taxes. Corruption is the main agency for generating BM while other things like manipulation of accounts, under reporting and out of book transactions are also used frequently. For e.g., in the case of real estate, tax amount for both buyers and sellers increases with increasing prices in the form of stamp duty and capital gains tax. Given the low guideline values of properties, real estate transactions are made partly in cash leading to gross under reporting. Another good example would be Non-profit organizations where most of the charities are registered. This structure is often misused to generate BM. Entertainment industry (movies) is another example where the black to white ratio in a medium budget movie is 60:40.

Black Money thus generated immediately reaches tax havens like Switzerland, Luxemburg, Mauritius, Dubai, Channel Islands, etc. The Switzerland banks by far account for the largest share at 30%. Monies parked in such tax havens then comes back to India in the form of Foreign Direct Investment (FDI) thereby gaining legitimacy.

Why is it difficult to bring it back? Since we know where the BM is residing, we need to have disclosure treaties with the tax havens in order to bring them back. However, such tax havens may not be too keen to have such treaties since their very business model is affected. Hence, we do not have a legal framework to bring it back. Also, slower implementation of steps to find BM hoarders also contribute to the problem. Many of the people behind BM generation are influential people with powerful connections. Hence, they can easily slow down the process.

How to bring it back?

Governments have tried to tackle this problem by enacting new laws. Tough laws have been enacted recently in the name of “Black Money Undisclosed Foreign Income and Assets Act” and “Prevention of Money Laundering Act”. These laws give enormous power to the Enforcement Directorate (ED) to attach and confiscate properties of an accused equivalent to the amount stashed abroad. Also, several amnesty schemes have been announced over time. However, the results so far are not impressive though it may be early to comment.

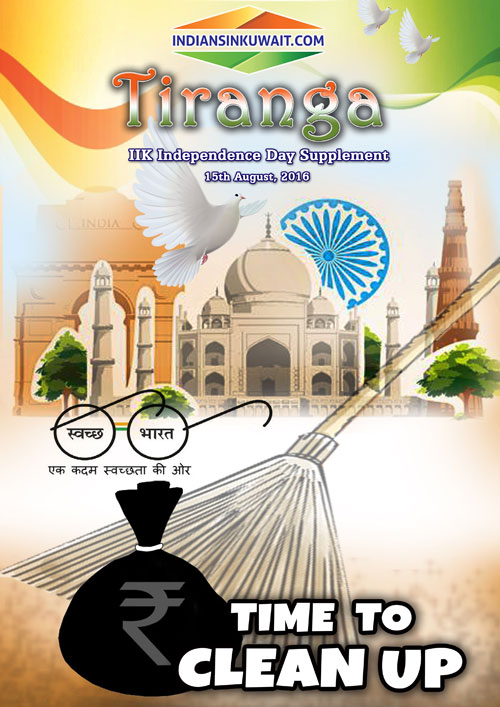

In my view, while focusing on bringing BM stashed abroad back to the country we should focus more on preventing further generation of BM. Technology can play a huge role here. Already we are seeing the impact of Permanent Account Number (PAN) being required to do many transactions. Having a detailed trail of transaction in itself can prevent further generation of BM. Secondly, sectors and activities that are “BM friendly” should be focused specifically for more reforms and transparency. For eg., removal of complex documentation process and creation of one-stop shop for all real estate transaction could help us in this regard.

Finally, there should be political will to take this head on and bring results. While it may annihilate a few powerful people, the vast sums of money brought back can be put to good use to build roads and bridges and position India as an “ethical” country where doing business is easy.